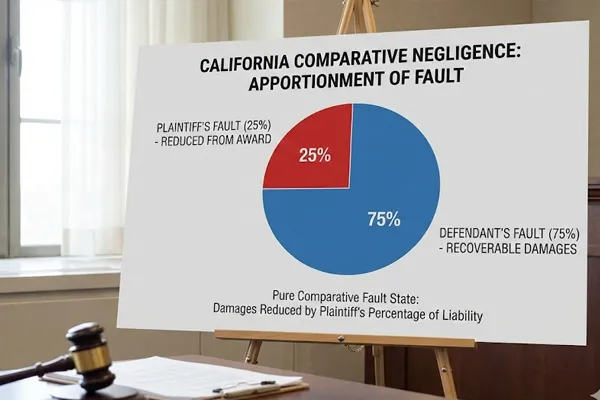

Many states bar you from suing if you were 50% or more at fault. California is different. We follow a “Pure Comparative Negligence” standard. This means you can recover damages even if you were 99% at fault. Your award is simply reduced by your percentage of blame. If a jury awards you $100,000 but finds you 40% at fault, you still walk away with $60,000. Never assume you don’t have a case just because you made a mistake.

Shared Fault Accident in San Diego: how do comparative negligence rules cut your recovery?

Under California Law, the most important rule is this: never accept a “shared fault” label until the insurer proves it with evidence. Comparative negligence is a math problem for them and a leverage problem for you, and they try to solve it early—before the facts are locked down.

How insurers manufacture shared fault in San Diego crashes

When the carrier smells any ambiguity, they push “comparative fault” because it reduces exposure without debating your injuries. I’ve sat across from defense-trained adjusters and lawyers long enough to tell you the playbook: pick one driving choice you made, inflate it, and discount everything else.

One anonymized San Diego scenario: a client was hit in a lane change chain-reaction near Mission Valley. Liability was mostly on the rear driver, but the insurer tried to pin a percentage on my client for “unsafe movement.” We treated it like a trial file from day one—secured traffic camera footage, mapped vehicle damage, and tied timing to witness statements. When the carrier didn’t move, we prepared for filing in San Diego Superior Court under California Law and put their “50/50” story on a collision reconstruction timeline. The result wasn’t magic; it was proof and pressure applied in the right order.

- They assign fault before they investigate: early percentages are often negotiating anchors, not conclusions.

- They cherry-pick one fact: “You merged,” “you braked,” “you were in the wrong lane,” then ignore speed, distraction, or following distance.

- They exploit gaps: no photos, delayed treatment, or missing witnesses becomes “uncertainty,” and uncertainty becomes “your fault.”

Jurisdictional authority: why California’s comparative fault rules matter in San Diego Superior Court

California is a comparative negligence state. In plain terms: your recovery can be reduced by the percentage of fault assigned to you, but it is not wiped out just because you share some blame. That’s the legal framework the defense works inside, and it’s why “we’ll accept 30% on the front end” is usually a bad habit.

In San Diego Superior Court, comparative fault is not a vibe—it’s a burden-of-proof fight built on evidence, testimony, and credibility. The carrier’s early allocation only matters if it survives scrutiny: crash dynamics, timeline, and what the roadway rules actually required in the moment. Under California Law, your job is to make their percentage expensive to defend.

The “Immediate 5”: comparative negligence questions real San Diego victims ask

1) If I’m partially at fault in a San Diego crash, can I still recover money?

Yes. Under California Law, comparative negligence generally allows recovery even when you share fault, but your damages can be reduced by your percentage. The fight is over the number—because a small swing in fault percentage can change the check by thousands. Insurers often push a high number early because it’s easier to negotiate down than to justify up.

2) Who decides the percentage of fault—insurance or the court?

Insurance companies assign percentages in their own evaluation process, but that’s not a legal ruling. If the case is litigated in San Diego Superior Court, fault allocation is decided through the litigation process based on evidence and credibility. Treat the adjuster’s percentage as an opening demand from the defense side, not the truth.

3) What evidence actually moves a “shared fault” case in San Diego?

Evidence that pins down timing and movement wins these cases. The practical hierarchy is: objective video, clean scene photos, vehicle damage patterns, and independent witnesses—then medical records that match the claimed mechanism. When those items are missing, insurers fill the gap with assumptions that conveniently assign you fault.

4) What are the most common comparative fault arguments insurers use in San Diego?

The patterns repeat: unsafe lane change, sudden braking, “following too closely” flipped onto you, distracted driving insinuations, and failure to keep a proper lookout. On freeways like I-5, I-805, and I-15, they also argue “merge responsibility” because it sounds intuitive to jurors and adjusters. The defense goal is to turn normal driving decisions into negligence.

5) How does shared fault affect settlement value versus litigation in San Diego Superior Court?

Pre-suit, insurers use comparative fault to discount value and slow negotiations because they claim the case is “disputed.” Once filed in San Diego Superior Court, they face discovery obligations and the risk of a public, evidence-based fault allocation that may be lower than their invented percentage. Litigation changes leverage because it forces them to defend their number under oath instead of in a spreadsheet.

Shared fault cases are won by controlling the narrative early and then proving it. If you let the insurer define the story first, you spend the rest of the case trying to climb out of a hole they dug with a percentage.

- Lock the timeline: where each vehicle was, when it moved, and what triggered the impact.

- Match damage to movement: photos and repair documentation should support your version of the crash.

- Keep medical timing clean: delays become “not hurt” and then “not careful.”

Magnitude expansion: how shared fault changes proof and strategy in San Diego

A) Evidence Evaluation in San Diego Cases

Comparative fault is an evidence war disguised as a negotiation. Insurers discount when they can plausibly blame you, and they retreat when they can’t.

- Police reports vs medical records: we align reported mechanics with the injury pattern and timeline to prevent “inconsistent story” attacks.

- Scene photos vs repair documentation: photos show lane geometry and sightlines; repairs show impact direction and force distribution.

- Treatment timeline consistency: gaps get used to argue you were fine, then to argue your driving was “reckless” or “distracted.”

B) Settlement vs Litigation Reality

Pre-suit, they can throw out a percentage without consequence. Post-filing in San Diego Superior Court, that percentage has to survive depositions, expert analysis, and cross-examination.

- Discovery forces specificity: vague claims like “unsafe maneuver” must become provable facts.

- Leverage shifts when defense witnesses commit: once stories are locked, bluffing becomes harder.

- Risk becomes real: a jury can assign less fault than the insurer claims, and the carrier knows it.

C) San Diego-Specific Claim Wrinkles

San Diego traffic creates predictable insurer behavior. High-density merges, tourist driving, and freeway interchanges give them easy “you should have been more careful” talking points.

- Traffic density and rear-end patterns: they try to turn normal braking into “sudden stop” negligence.

- Multi-vehicle freeway collisions: they spread blame across drivers to dilute the at-fault party’s share.

- Common Southern California insurer resistance patterns: fast fault assignment, slow evidence review, and “shared negligence” as the default discount.

Lived Experiences

Cassandra

“The insurance company said it was ‘split liability’ on day two. Richard pulled the footage, lined up the damage with the lane positions, and the percentage they claimed quietly disappeared.”

Connor

“They kept repeating that I ‘shouldn’t have merged.’ Richard focused on what the other driver did and what the evidence showed, and the case finally valued like the injuries mattered.”

California Statutory Framework & Legal Authority

|

Attorney Advertising, Legal Disclosure & Authorship

ATTORNEY ADVERTISING.

This content is provided for general informational and educational purposes only and does not constitute legal advice.

Under the California Rules of Professional Conduct and applicable State Bar of California advertising regulations,

this material may be considered attorney advertising.

Viewing or reading this content does not create an attorney-client relationship.

Laws and procedures governing personal injury claims vary by jurisdiction and may change over time.

You should consult a qualified California personal injury attorney regarding your specific situation before taking any legal action.

Responsible Attorney:

Richard Morse, California Attorney (Bar No. 289241).

Morse Injury Law is a practice name and location used by Richard Peter Morse III, a California-licensed attorney.

About the Author & Legal Review Process

This article was prepared by the legal editorial team supporting Richard Peter Morse III,

with the goal of explaining California personal injury law and claims procedures in clear, accurate, and practical terms for injured individuals in San Diego and surrounding communities.

Legal Review:

This content was reviewed and approved by Richard Morse, a California-licensed attorney (Bar No. 289241),

who concentrates his practice on personal injury litigation and insurance claim disputes.

With more than 13 years of experience representing injury victims throughout California,

Mr. Morse focuses on serious personal injury matters including motor vehicle collisions, uninsured and underinsured motorist claims,

premises liability, catastrophic injury, and wrongful death.

His practice emphasizes claims evaluation, insurance carrier accountability, and litigation in California courts when fair resolution cannot be achieved.

|